Until now, best practice for high value technology sales has comprised three steps:

- Discover a prospective customer issue that you can solve, perceived at C-Level to be disruptive

- Quantify the cost or missed value of not solving the disruption

- Propose a solution, evidenced with relevant references

Success with step 1 has been widely accepted, until now, as a validation of a qualified prospective customer.

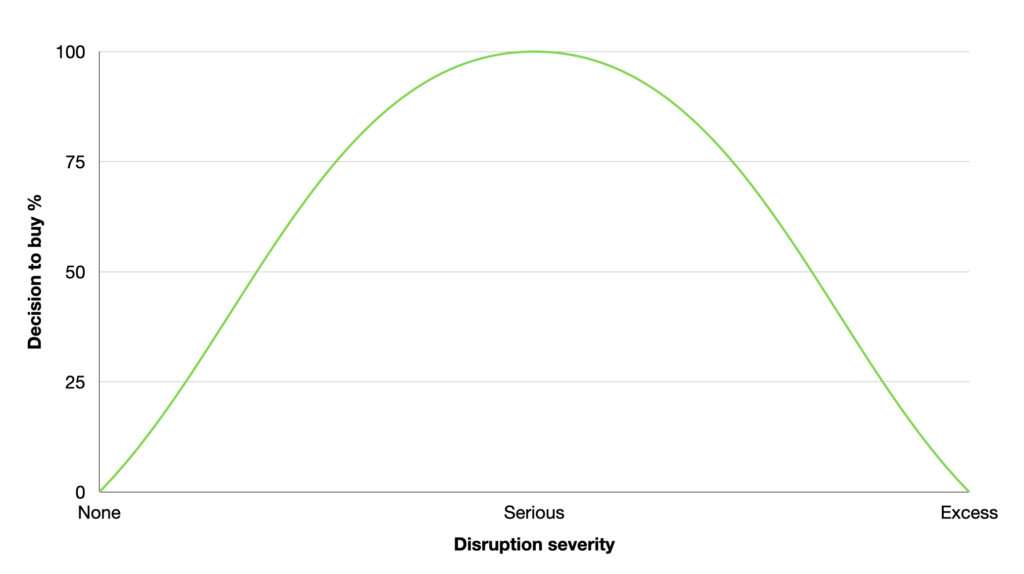

In step 2, the bigger the disruption and consequential costs (or lost value), the more a prospect is willing to invest in a new solution.

Covid 19 has locked down my sales

The crisis has re-written the sales rulebook about disruption, and it’s all down to uncertainty. The new dynamic is that too much disruption in an organisation will have an opposite effect on purchase decisions. Above a certain level of disruption, the uncertainty created, stops new IT purchasing activity.

We can see that represented in the decision to buy curve below.

Uncertainty causes decision paralysis

To understand this issue more fully, I’d like to use two reference points; one from 2003 and one from 2020.

Doing Nothing

In Christopher Anderson’s 2003 paper “The Psychology of Doing Nothing” , he looks at why people avoid making decisions. A leading factor is preferring the stability of doing nothing. Not making a decision means avoiding any regrets, should a system be bought that later fails. However, legacy IT systems that do not support current business models are a major inhibitor.

The Catalyst

In Jonah Berger’s 2020 book “The Catalyst”, one of what he describes as the “four horsemen of inertia” is uncertainty. During tests, an uncertain outcome was proven to cause decisions to be postponed.

We can see now with the crisis that disruption of many organisations has become so severe that uncertainty has overtaken all other matters. This has blocked many organisations’ decision making, including IT solution purchases.

To be successful in this new environment, technology sales must evolve. To remain effective and successful, doing the same thing and expecting a different result is no longer an option.

Top five tips to win business in a crisis

- Pipeline validation

Prospective customers must be carefully researched, to avoid targeting those that are facing such severe disruption that no matter how compelling your business case is, no decision will be made (in some cases those businesses may not survive).

In a new McKinsey report “The Great Acceleration” the gap between those at the top and bottom of the power curve of economic profit has been dramatically widened by Covid 19. The report concludes “you will need to be faster, bolder and more agile than ever before to succeed”.

- Inertia risk assessment

Quantify the cost and expose the adverse consequences of the status quo, as Conrad Smith and his fellow authors outline in their book, Three Value Conversations. Old IT systems cause hidden costs, which arise from either: unmet needs, undervaluing current needs or not considering future needs, concealed by costly workarounds. - The Business Case (BC)

This has to solve a must fix critical issue and, using the customer’s own data, clearly define the new solution’s value. Now business cases are scrutinised at much higher levels, up to and including CEO. If the business case is solid, the sales can happen very quickly, with full C level support.

I have written three insights about the business case and how to build one:

- Simplicity

Make every step in the buying cycle easier. Ideally, also make it reversible to remove the buyer’s fear of failure. As land and expand is now the default way technology is purchased, once the new customer is landed, delivering success and value, quickly, is essential to meet customer acquisition cost vs. customer life values metrics and reduce churn.

- References

Evidence must be relevant to the prospective customer. Jonah Berger tells us in the Catalyst that for “Corroborating evidence” to be effective, the prospect must be able to see similarities between the reference user and themselves. Also that multiple references work better, delivered over a short space of time.

Case studies must be short, factual and describe quantifiable value, which the solution delivers.

To conclude on a positive note: I have personal experience of winning some very large technology transactions during severe economic downturns, but only when the solution addressed an essential must fix issue, in organisations that had an area of their operation that was growing and evidenced with a solid business case.